The 4×4 Financial Independence Plan SM

Our unique and proprietary financial planning system that will help you achieve your financial independence, today.

Overview

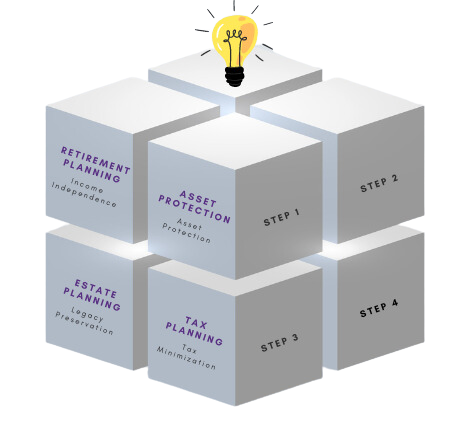

At our company, we believe in going beyond traditional financial planning to offer a one-of-a-kind approach that sets our clients on the road to success. The 4 x 4 Financial Independence Plan ℠ is a proprietary system that combines 4 Essential Elements with 4 Sequential Steps, unlocking the potential for financial independence at any stage of life.

What makes our plan truly unique is it’s ability to build upon traditional financing and incorporate our clients’ most significant assets, their real estate. By leveraging this valuable resource, we empower individuals to maximize their financial goals like never before. And that’s not all! Our plan also embraces self-directed retirement accounts, opening doors to diverse investment opportunities beyond the usual stocks, bonds, and mutual funds.

With The 4 x 4 Financial Independence Plan ℠, you can chart a course towards a secure and prosperous future, irrespective of your age or current financial standing. Say goodbye to cookie-cutter strategies and welcome a personalized approach that leads you towards financial independence and lasting success.

Take the first step on your journey to financial freedom with us today!

Our Unique and Propertiery System

Discover a Better, Smarter, and Safer way to achieve your financial goals with our exclusive and proprietary system. The 4×4 Financial Independence Plan ℠ is a comprehensive and distinctive approach designed to lead you towards financial independence while efficiently planning for retirement, safeguarding your assets, preserving your legacy, and minimizing tax burdens. Our unique plan combines four essential elements with a carefully crafted sequence of four sequential steps, empowering you to take control of your financial future.

Below you will find further more information about the 4 Essential Elements and 4 Sequential Steps.

The 4 Essential Elements

Retirement Planning

“Income Independence” – Everyone is at a different phase of their financial life. When one is younger, the focus is mainly on asset accumulation. The goal is to earn a living. Then, save and invest enough money to finance a lifestyle today and ultimately accumulate enough assets to finance a lifestyle from those assets in the future. Generally, people refer to this as “retirement”. We prefer to refer to it as “Financial Independence”, when your assets are sufficient to provide with an income so that work is no longer a requirement. Instead, work is an option. Income planning is the process of taking you from where you are today that place, to financial independence.

Asset Protection

“Asset Protection” – Protecting what you have from those that would take it from you is asset protection. The “takers” can be creditors, relatives, the government, and others. Your assets not only include traditional things like stocks, bonds, and real estate. For many, their single biggest asset will be their ability to earn an income over their lifetime. That needs to be protected too. The goal is simply to create barriers and boundaries that prevent and/or deter others from taking what you have earned.

Estate Planning

“Legacy Preservation” – We look at our financial lives in two phases; one while you are living and the other when you are not. I call this your life and your legacy. Think of it as asset protection once you are no longer here to physically protect your assets. The goal of estate planning is to ensure that what you have accomplished in your live will be passed on to your future legacy in a manner that you choose.

Tax Planning

“Tax Minimization” – Taxes are life’s single biggest expense. Yet, like most expenses, paying taxes are a choice that you get to make. It’s not that you get to choose if you should or should not pay taxes. It is simply a matter of making tax-efficient financial decisions. This is the principle of “The Net” which states, “it’s not what you make, it’s what you keep that matters.” In our opinion, any comprehensive financial plan needs to address each of the essential elements, simultaneously, or the plan falls short of being as effective as possible.

The 4 Sequential Steps

The 4 Foundational Modules

The 4×4 Financial Independence Plan ℠ is comprised of our 4 signature foundational financial modules. Each module represents a crucial element and a sequential step towards achieving your financial independence. Delve into the details of each module by clicking the links below to learn more.

Retirement Planning

The Smart Financial Independence Blueprint ℠

Asset Protection

The Smart Asset Protection Planner ℠

Estate Planning

The Smart Legacy Plan Organizer ℠

Tax Planning

The Smart Tax Minimizer ℠ (For Consumer and Home-Based Businesses)

Pricing Breakdown

There are a few options to choose from, based on your needs.

The Gold – The 4×4 Financial Independence Plan ˢᵐ is our one-on-one coaching plan which includes live financial coaching with an independent fiduciary advisor, registered financial consultant, and lifestyle coach.

The Silver – The 4×4 Financial Independence Plan ˢᵐ is for individuals who would like to complete the program on their own – DIY.

If you are looking to develop a comprehensive financial income plan, and aren’t sure if you are ready for The 4×4 Financial Independence Plan ˢᵐ, you can start with our basic option, The Smart Financial Independence Blueprint ˢᵐ.

Both the Silver and Gold plans include access to all 4 foundational financial modules.

GET STARTED

Our team of Registered Financial Consultants and Independent Fiduciary Advisors will guide you toward discovering a new way to achieve financial independence with our unique and proprietary approach.

Enjoy the benefits of all 4 Foundational Financial Modules — Retirement Planning, Asset Protection, Estate Planning, and Tax Planning.

Find your financial independence, TODAY!

Financial Sherpa

A Financial Sherpa Can Help You To-and-Through Your Retirement.