Educational Blog

Financial Edification

Latest News

Browse All Articles, Videos, Podcasts

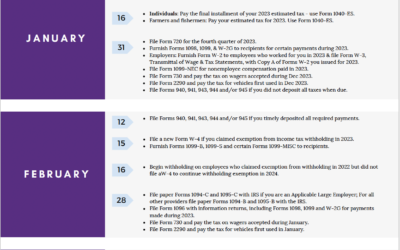

2024 Federal Tax Calendar

Financial GuidesKnow Your 2024 Tax Deadlines with This Useful PDF Tax Calendar For small businesses, staying on top of...

Cybersecurity Monthly Newsletter March 2024

Asset ProtectionIn this issue: How to beat the password paradox Cybersecurity Shorts Software Updates Welcome to your...

Your Co-Owned Business Probably Needs a Buy-Sell Agreement

Tax PlanningBradford Tax InstituteSay you’re a co-owner of an existing business. Or you might be buying an existing...

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

The Smart Tax Planning Newsletter March 2024

Tax PlanningIn This Issue: IRAs for Young Adults Get Up to $32,220 in Sick and Family Leave Tax Credits New Crypto Tax...

2024 Key Planning & Investment Deadlines for Q2

Financial GuidesSpring is coming and to keep you financially organized for Q2, we are providing you with our Spring...

New IRS Crypto Tax Reporting Rules Coming Soon

Tax PlanningBradford Tax InstituteMarch 2024The IRS released over 280 pages of proposed regulations intended to...

Social Security, Medicare, and HSAs

Retirement PlanningBy Elaine Floyd, CFPIf your employer health plan is a health savings account (HSA) paired with a...

Cybersecurity Monthly Newsletter February 2024

Asset ProtectionIn this issue: Your Email Address: The Key to Your Digital Life Cybersecurity Shorts Software Updates...

4 Keys to the Millennial Balancing Act of Paying Off Student Debt and Saving for Retirement

Retirement PlanningBy Debra Taylor, CPA/PFS, JD, CDFAThe financial puzzle for millennials: What’s the best way to pay...

Cybersecurity Monthly Newsletter January 2024

Asset ProtectionIn this issue: 2024: Perform a Cybersecurity Audit Cybersecurity Shorts Software Updates Welcome to...

Real Estate Rentals: Recent Tax Insights

Tax PlanningAn Exclusive Report fromBradford Tax InstituteKey Topics Include: How to Project If a Rental Property Is a...

Browse By Topic

- Baby Boomers

- Benefits

- Budget

- Capital Gains

- Charity

- Children as employees

- College

- Consumers

- Corporations

- Cost Segregation

- Cybersecurity

- Crypto

- Depreciation

- Disability

- Divorce

- Education

- Employees

- Entertainment

- Estates

- Extensions

- Filing tips

- Form 1099

- Gifts

- Health Care

- Health Savings Account

- Home Office

- Home-Based Business

- Independent Contractor

- Insurance

- Investments

- Investment Properties

- Leases

- Life Insurance

- Loans

- Losses

- Medical

- Parents

- Professionals

- Quick Guide and Checklist

- Real Estate

- Rental Properties

- Retirement

- SECURE Act 2.0

- Self-Employment Tax

- Shared Equity

- Small Business Owner

- Social Security

- Spouse

- Strategies

- Tax Credits

- Tax Exemptions

- Tax Planning

- Tax Tips

- Travel

- W2 Employee

- Vacation

Big Tax Changes to Know for 2024

Financial Guides2024 has brought some big tax changes with it. It’s essential to stay informed about these...

2024 Key Planning & Investment Deadlines for Q2

Financial GuidesSpring is coming and to keep you financially organized for Q2, we are providing you with our Spring...

Social Security, Medicare, and HSAs

Retirement PlanningBy Elaine Floyd, CFPIf your employer health plan is a health savings account (HSA) paired with a...

4 Keys to the Millennial Balancing Act of Paying Off Student Debt and Saving for Retirement

Retirement PlanningBy Debra Taylor, CPA/PFS, JD, CDFAThe financial puzzle for millennials: What’s the best way to pay...

2024 Key Financial Data Guide

Financial GuidesAs we step into the new year, it's wise to review your tax plan in light of recent changes. Our 2024...

2024 Social Security Quick Reference Guide

Financial GuidesHappy New Year! As we usher in 2024, we sincerely wish you a year marked by a robust economic recovery...

2024 Retirement Calendar Checklist

Financial GuidesHappy New Year! I hope you and your family had a joyous and safe holiday and made many warm memories....

2024 Health Care Quick Reference Guide

Financial GuidesCertain birth dates represent crucial milestones that affect your overall financial and retirement...

2024 Key Planning & Investment Deadlines for Q1

Financial GuidesDo you know what days the market closes for 2024? Or when different tax forms are due? Or when the...