About Us

We are a team of Registered Financial Consultants and Independent Fiduciary Advisors dedicated to serving a diverse clientele, ranging from successful business owners and real estate investors to late-stage pre-retirees, CPAs, and attorneys. Our expertise spans across various fields, ensuring we cater to everyone in between.

We take immense pride in being Main Street Certified Tax Advisors. We offer “street smart tax strategies” to business owners and investors, helping our clients build wealth, safeguard their assets, and plan their estate and legacy.

At our core, we are committed to empowering our clients and professionals to achieve their financial aspirations. Through our comprehensive strategies, we provide tailored guidance to help individuals reach their specific financial goals. What sets us apart is our distinctive approach, which combines real estate integration and self-directed financial planning, consulting, and coaching services.

With a profound understanding of both the financial industry and the intricacies of real estate, our knowledge base is broad and varied. This allows us to offer expert financial advice that often surpasses the expectations of our clients and even many professionals in the field. We pride ourselves on staying ahead of the curve and providing unique solutions that others may not be aware of.

By choosing us as your financial partners, you gain access to a team that not only understands your unique circumstances but also possesses the knowledge and experience to guide you towards success. We are passionate about helping you navigate the complexities of finance and real estate, ultimately empowering you to make informed decisions that will shape your financial future.

Why We Are Different

Your Best Interest is Our Top Priority

In his renowned book “Unshakeable,” Tony Robbins sheds light on a distinctive and exclusive group of financial advisors known as Independent Fiduciary Advisors. According to Robbins, out of the approximately 308,000 advisors in existence, a mere 1% fall under the category of Independent Fiduciary Advisors. We take immense pride in being part of this esteemed group here at Lifetime Paradigm.

As Independent Fiduciary Advisors, we are legally required to always act in our clients’ best interest. While most people assume that all advisors operate under the same principle, the reality is quite different. In truth, the majority of advisors are employed by broker-dealers, and their primary duty is to prioritize the interests of their employers over those of their clients. There are times when interests align, and there are times when they do not. The problem lies in the uncertainty that surrounds this misalignment.

Another potential problem with the broker-dealer model that sets Lifetime Paradigm apart, is their legal “standard” for advice, which is referred to as “suitability”. Suitability implies that if a client can hypothetically endure a potential investment loss, a broker-dealer’s advisor can recommend it, even if it results in a financial loss of funds. If the client can bear the financial consequences, then the broker-dealer’s representative is authorized to make the recommendation, absolving themselves of any liability in case of adverse outcomes. This approach, in our view, does not align with the notion of acting in the “client’s best interest.” In fact, it seems quite far from it. It is important to note that 99% of all advisors work within the broker-dealer framework, but Lifetime Paradigm’s advisors do not.

As Registered Financial Consultants and Independent Fiduciary Advisors, our utmost priority is to ensure that your financial well-being is established in a manner that resonates with your values and aligns with your aspirations. We are committed to your success and helping you reach your goals.

Incorporating Real Estate Into Our Plans

Another unique aspect that sets Lifetime Paradigm apart from almost all other advisory firms is our exceptional ability and expertise in providing guidance on our clients’ most significant assets: their businesses and/or real estate investments. We recognize the importance of these assets and are well-equipped to offer valuable insights and assistance. Unlike many other advisors who lack knowledge or experience in these crucial financial areas, we possess the necessary expertise to help our clients navigate their mortgages and taxes effectively.

In fact, most advisors are prohibited from offering support in these critical areas. However, at Lifetime Paradigm, we understand that our clients’ businesses, real estate holdings, and liabilities play a pivotal role in their overall financial picture. Consequently, incorporating these key elements into our clients’ financial plans is a fundamental aspect of our process. We go beyond traditional advisory services to ensure that all aspects of our clients’ financial lives are accounted for and optimized.

Our Unique and Propriety Systems

At Lifetime Paradigm, when it comes to our client’s financial goals, we believe there is a Better, Smarter, and Safer to plan for retirement, protect your assets, preserve your legacy, and minimize tax liabilities.

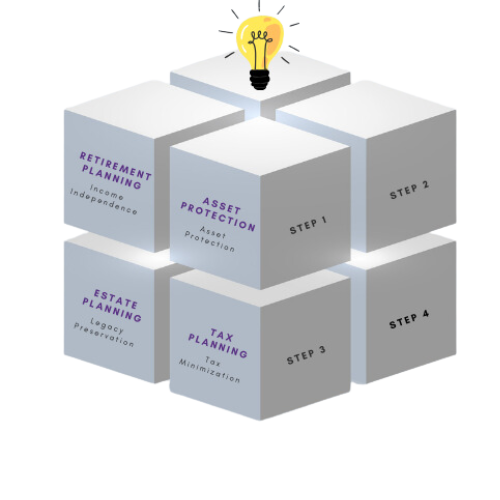

This is why we developed The 4×4 Financial Independence Plan sm, our exclusive and distinctive system tailored to empower our clients on their path to financial independence. This comprehensive plan comprises four essential elements and follows a well-structured sequence of four sequential steps.

Our Unique Approach:

4 Essential Elements x 4 Sequential Steps

What truly sets our approach apart is the integration of our 4 essential elements and 4 sequential steps. This distinctive combination empowers our clients to achieve their financial goals and attain financial independence, regardless of their age.

Financial Independence

At Lifetime Paradigm, our primary mission is to assist our clients in achieving financial independence. “When the assets you have provide the income you need to live the life you want and, your work is no longer a requirement, it’s an option.” We firmly believe that, with careful and strategic planning, this goal can be achieved at any stage of life.

Our dedicated team is committed to working alongside you, developing a customized plan tailored to your unique circumstances and aspirations. By implementing proven strategies and leveraging our expertise, we guide you towards the realization of financial independence. Our comprehensive approach takes into account your current financial situation, your goals, and your vision for the future.

Imagine a life where you no longer feel the pressure to work solely for financial security. Instead, you have the freedom to pursue your passions, spend quality time with loved ones, and embrace new opportunities that align with your values and aspirations. We are here to provide the knowledge, guidance, and support necessary to turn this vision into a reality.

With our assistance, financial independence becomes a tangible goal that transcends age or stage in life. Whether you’re starting your career, approaching retirement, or somewhere in between, we are dedicated to helping you unlock the doors to financial independence and create a future where you have the power to live life on your terms.

Consulting & Coaching Services

At Lifetime Paradigm, we offer comprehensive consulting and coaching services designed to equip our clients with the knowledge and tools necessary to reach their financial goals. We understand the need for ongoing guidance as your financial circumstances evolve or as new opportunities emerge. In such instances, our team of Independent Fiduciary Advisors is readily available to provide additional coaching or consulting services. We are committed to ensuring that you always have the support and expertise you need, whenever you need it.

Our Team

Randall A Luebke

President | Lifetime Paradigm, Inc.

RFC, RMA, CWPP, CMP, MSCTA

Financial Consultant, Fiduciary Advisor, Coach

Randy Luebke is the President and founder of Lifetime Paradigm, a Registered Financial Consultant and, an Independent Fiduciary Investment Advisor. Randy has over 35 years of experience helping business owners, real estate investors, and successful consumers throughout the United States.

As a Real Estate Investor and Self-Directed Investor, Randy applies practical experience to his knowledge, and his passion for continuous professional development is evident through his certifications as a Main Street Certified Tax Advisor, Certified Medicaid Planner, and Certified Wealth Protection Planner.

Randy has a diverse background as a Business Owner, Mortgage Broker, Real Estate Broker, Life Insurance Agent, Annuity Agent, and Long-Term Care Agent. He also provides investment advice through his Registered Investment Advisory (RIA), Lifetime Financial, Inc. In addition, with his long-time friend, attorney and CPA, Mark J Kohler, Randy has also co-authored the book “The Business Owner’s Guide to Financial Freedom: What Wall Street Isn’t Telling You,” sharing his invaluable insights for achieving financial independence.

Phil Ingle

Production Partner | Lifetime Paradigm, Inc.

Financial Advisor, Investment Advisor Representative, Registered Financial Consultant

Phil leads a team who are dedicated to helping you identify and reach your Retirement Secure Strategic Goals. Since 1993, Phil has been providing Financial, Retirement, Insurance and Estate Planning Solutions throughout Southern California.

As a frequent public speaker and past host of the “Ensure Your Retirement” Radio Show, he takes a proactive approach to educating his listeners and clients about the most up-to-date financial and retirement strategies that are available today for pre and post-retirees.

Len Bakker

Financial Consultant, Financial Advisor, Coach

Len is a Registered Financial Consultant and an Independent Fiduciary Advisor with 23 years of experience helping clients develop successful financial strategies. He is experienced in financial planning, advanced tax planning and legacy strategies. He comes from a family that ran a highly successful small business owners and he is aware of the benefits and necessities of a holistic financial planning approach.

David Hoffman

Financial Consultant and Independent Fiduciary Advisor| Lifetime Paradigm, Inc.

David is a Financial Consultant and Fiduciary Advisor, with an extensive background spanning over 20+ years in real estate and mortgage lending. David is equipped with a broad range of services designed to support clients in achieving their financial goals and navigating the complexities of financial planning. Whether you’re embarking on the journey of homeownership, real estate investment, planning for retirement, or seeking to reduce the taxes you pay, David remains dedicated to providing personalized guidance tailored to your unique needs and aspirations.

Yulia Ordway

Tax Planning Specialist, MSCTA | Lifetime Paradigm, Inc.

Yulia Ordway is our esteemed Tax Planning Specialist at Lifetime Paradigm. She brings a wealth of experience from the legal and financial planning industries. Her journey began as a dedicated paralegal for a large corporation, and she later ventured into the world of financial planning, excelling as a paraplanner and investment services administrator.

With a passion for simplifying tax complexities and an unwavering commitment to providing comprehensive tax-efficient strategies, Yulia ensures that her clients’ best interests are always at the forefront. Her integrity and dedication are at the core of her approach, fostering trust and confidence in every client she serves.

Yulia’s list of professional accomplishments is truly impressive. She is a Certified Main Street Tax Advisor, and has completed her Certified Financial Planner exam. Additionally, she holds licenses as a Life Insurance Agent, Health Insurance Agent, and has previously been licensed for Series 6 and Series 63. Her commitment to continuous improvement led her to complete a Financial Planning Association (FPA) Residency and become certified in College Aid Pro.

Outside of work, Yulia cherishes spending time with her wonderful daughter and parents. She’s a passionate learner who enjoys listening to podcasts during leisurely walks with her loyal dog, Frodo. Additionally, Yulia enjoys finding solace by the ocean or a peaceful lake, which rejuvenates her spirit and fuels her dedication to excelling in her profession.

At Lifetime Paradigm, we are proud to have Yulia on our team, where her expertise, dedication, and passion for tax planning continue to make a meaningful impact on our clients’ financial well-being. Her aspiration to grow and expand her knowledge exemplifies her commitment to excellence in her field.

Carol Gallardo

Operations Manager

Jana Wishengrad

Marketing Consultant

Jana is an experienced Marketing Consultant with a diverse background in various industries, including interior design, real estate, and project coordination. Throughout her career, she has demonstrated expertise in client management, sales, design consultation, and marketing. With a keen eye for detail and strong organizational skills, she has effectively supported professionals and teams, ensuring smooth operations and successful project outcomes.

Request a Complimentary Appointment

Schedule an interview to help us understand your unique situation and, for you to learn about our services and approach. This complimentary consultation is your time to ask questions about what we do and how we can help you. Then, we can mutually assess your needs and our capabilities to see if there is a good fit!